- Best platform to buy cryptocurrency

- Crypto live charts

- Crypto fees

- Where to buy bitcoin

- Binance dogecoin usd

- Lossless crypto

- Current eth gas price

- Btc prices

- Bitcash price

- What is crypto coin

- Buy bitcoin online

- Cours crypto

- Mina crypto price

- How much is pi crypto worth

- Will btc go back up

- Cryptocom sell to fiat wallet

- Google bitcoin

- How to buy xrp on cryptocom

- Ripple xrp cryptocurrency

- How does bit coin work

- Mbtc to usd converter

- Crypto credit

- How to fund crypto com account

- How to withdraw money from cryptocom

- To invest all profits in crypto

- Eth btc

- Btc address lookup

- Will ethereum ever reach $10 000 in price

- 3 reasons to buy dogecoin

- Dot crypto

- Cryptocurrency bitcoin price

- Bitcoin starting price

- Largest bitcoin holders

- Cryptocurrency app

- How to buy dogecoin stock on coinbase

- Cheapest crypto on crypto com

- Coindesk bitcoin price

- Eth to usd converter

- How to buy crypto on binance

- Multichain ethereum binance smart chain avalanche

- Crypto earn

- Cryptocurrency exchanges

- Cryptocoin com coin

- Ether converter

- Best websites to buy bitcoin with credit card

- Cryptocurrency prices

- How to add bank account to cryptocom

- Crypto exchange

- How much is bitcoin

- How does btc mining work

- Ethereum gas fees tracker

- Top 20 cryptocurrency

- How much is 1eth

- What's the price of bitcoin

- Amp crypto stock

- How to invest in ethereum

- When to buy bitcoin

- Apps cryptocurrency

- Crypto to usd

- Ethusd converter

- Asm crypto price

- Where to buy bnb crypto

- Will crypto bounce back

- Cryptocom cards

- Bitcoin price going up

- Create cryptocurrency

- How is crypto taxed

- Who own bitcoin

- Dogecoin 20 where to buy

- Eth usdt

- Cryptos

- The crypto

10eth to usd

Best wallet for crypto

If you are looking to convert 10 ETH to USD and want to stay updated on the latest exchange rates and trends, these articles will provide you with valuable information. From analysis of the cryptocurrency market to tips on getting the best rates for your conversion, these articles will help you navigate the world of digital currency conversions with ease.

Understanding the Factors Affecting ETH to USD Exchange Rates

When it comes to understanding the factors influencing the exchange rates between Ethereum (ETH) and the US Dollar (USD), there are several key components to consider. These factors play a crucial role in determining the value of ETH against the USD in the global market.

One significant factor that affects the ETH to USD exchange rates is market demand. The higher the demand for ETH, the higher its value will be relative to the USD. Factors such as the popularity of Ethereum as a digital asset, its utility in decentralized applications, and investor sentiment can all influence market demand.

Another important factor to consider is government regulations and policies. Regulatory developments, such as restrictions on cryptocurrency trading or mining, can impact the value of ETH against the USD. Government actions in major markets, such as the US and China, can have a significant impact on the overall cryptocurrency market.

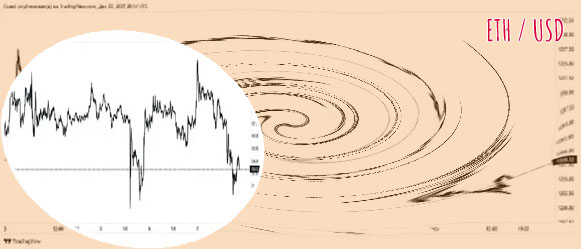

Market volatility is also a key factor affecting ETH to USD exchange rates. Fluctuations in the broader financial markets, geopolitical events, and macroeconomic indicators can all contribute to price volatility in the cryptocurrency market. Traders and investors must stay informed about market trends and developments to make informed decisions.

In addition, technological developments within the Ethereum ecosystem can also influence exchange rates. Upgrades to the Ethereum network, the introduction of new products and services,

Top Strategies for Converting ETH to USD at the Best Rates

Cryptocurrency trading has become increasingly popular in recent years, with Ethereum (ETH) being one of the most widely traded digital assets. As crypto investors seek to convert their ETH holdings into traditional fiat currency like USD, finding the best rates can be a challenge. Fortunately, there are several strategies that can help traders maximize their profits when converting ETH to USD.

One of the top strategies for converting ETH to USD at the best rates is to use a cryptocurrency exchange that offers competitive pricing and low fees. By shopping around and comparing the rates offered by different exchanges, traders can ensure that they are getting the most value for their Ethereum. Additionally, using a decentralized exchange (DEX) can help avoid excessive fees and provide a more secure trading experience.

Another effective strategy is to take advantage of arbitrage opportunities. Arbitrage involves buying ETH on one exchange where the price is lower and selling it on another exchange where the price is higher. This can help traders profit from price discrepancies and maximize their returns when converting ETH to USD.

Overall, by utilizing these top strategies for converting ETH to USD at the best rates, crypto investors can optimize their trading experience and achieve higher profits. For those looking to delve deeper into the world of cryptocurrency trading, it is recommended to explore topics such as market volatility, risk management

The Latest Trends in the ETH to USD Conversion Market

The ETH to USD conversion market is constantly evolving, with new trends emerging to meet the demands of traders and investors. Keeping up with these trends is crucial for anyone looking to make informed decisions in this dynamic market.

Here are some of the latest trends in the ETH to USD conversion market:

-

Increased adoption of decentralized exchanges (DEXs): DEXs have gained popularity in recent years due to their ability to provide users with more control over their funds. As a result, more traders are turning to DEXs for their ETH to USD conversions.

-

Rise of stablecoins: Stablecoins, such as USDT and USDC, have become an integral part of the cryptocurrency market. These coins are pegged to fiat currencies like the US dollar, providing traders with a stable asset to convert their ETH into when the market is volatile.

-

Growing interest in yield farming: Yield farming involves staking cryptocurrencies to earn rewards in the form of additional tokens. This trend has gained traction in the ETH to USD conversion market as traders look for ways to maximize their returns on investment.

-

Integration of decentralized finance (DeFi) protocols: DeFi protocols have revolutionized the way people interact with financial services, offering a range of products and services without the need for intermediaries.