- Best platform to buy cryptocurrency

- Crypto live charts

- Crypto fees

- Where to buy bitcoin

- Binance dogecoin usd

- Lossless crypto

- Current eth gas price

- Btc prices

- Bitcash price

- What is crypto coin

- Buy bitcoin online

- Cours crypto

- Mina crypto price

- How much is pi crypto worth

- Will btc go back up

- Cryptocom sell to fiat wallet

- Google bitcoin

- How to buy xrp on cryptocom

- Ripple xrp cryptocurrency

- How does bit coin work

- Mbtc to usd converter

- Crypto credit

- How to fund crypto com account

- How to withdraw money from cryptocom

- To invest all profits in crypto

- Eth btc

- Btc address lookup

- Will ethereum ever reach $10 000 in price

- 3 reasons to buy dogecoin

- Dot crypto

- Cryptocurrency bitcoin price

- Bitcoin starting price

- Largest bitcoin holders

- Cryptocurrency app

- How to buy dogecoin stock on coinbase

- Cheapest crypto on crypto com

- Coindesk bitcoin price

- Eth to usd converter

- How to buy crypto on binance

- Multichain ethereum binance smart chain avalanche

- Crypto earn

- Cryptocurrency exchanges

- Cryptocoin com coin

- Ether converter

- Best websites to buy bitcoin with credit card

- Cryptocurrency prices

- How to add bank account to cryptocom

- Crypto exchange

- How much is bitcoin

- How does btc mining work

- Ethereum gas fees tracker

- Top 20 cryptocurrency

- How much is 1eth

- What's the price of bitcoin

- Amp crypto stock

- How to invest in ethereum

- When to buy bitcoin

- Apps cryptocurrency

- Crypto to usd

- Ethusd converter

- Asm crypto price

- Where to buy bnb crypto

- Will crypto bounce back

- Cryptocom cards

- Bitcoin price going up

- Create cryptocurrency

- How is crypto taxed

- Who own bitcoin

- Dogecoin 20 where to buy

- Eth usdt

- Cryptos

- The crypto

Bitcoin cryptocurrency price

Best wallet for crypto

Bitcoin cryptocurrency price is a topic of great interest to many investors and traders in the financial market. Keeping track of the price movements of Bitcoin is crucial for making informed decisions when buying or selling this popular digital asset. To help navigate the complexities of Bitcoin's price fluctuations, we have compiled a list of 2 articles that offer valuable insights and analysis on this subject.

Understanding the Factors Influencing Bitcoin's Price Volatility

Bitcoin's price volatility is a topic of great interest and concern for investors and traders in the cryptocurrency market. Understanding the factors that influence this volatility is crucial for making informed decisions when buying or selling Bitcoin. Several key factors contribute to the price fluctuations of Bitcoin, including:

-

Market Demand and Supply: The basic economic principle of supply and demand plays a significant role in determining Bitcoin's price. When there is high demand for Bitcoin and limited supply, prices tend to rise, and vice versa.

-

Regulatory Developments: Regulatory changes and news can have a major impact on Bitcoin's price volatility. Positive regulatory developments, such as the approval of Bitcoin ETFs or the recognition of Bitcoin as a legal form of payment, can lead to price increases, while negative news, such as bans or restrictions, can cause prices to drop.

-

Market Sentiment: Sentiment among investors and traders can also influence Bitcoin's price volatility. Positive sentiment, such as optimism about the future of Bitcoin or the overall market, can lead to price increases, while negative sentiment can result in price declines.

-

Technological Developments: Technological advancements and improvements in the Bitcoin network can also impact price volatility. Upgrades such as Segregated Witness (SegWit) or the Lightning Network can

Strategies for Predicting Bitcoin Price Trends and Making Profitable Trades

Bitcoin has become a popular investment option for many individuals around the world. With its volatile nature, predicting price trends can be a challenging task. However, there are several strategies that traders can utilize to increase their chances of making profitable trades.

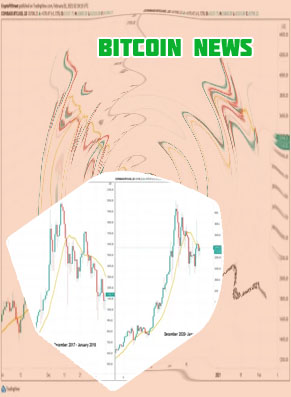

One effective strategy is technical analysis, which involves studying past market data to identify patterns and trends. By analyzing charts and indicators, traders can make informed decisions about when to buy or sell Bitcoin. Another useful strategy is fundamental analysis, which involves evaluating the underlying factors that can influence the price of Bitcoin. Factors such as regulatory developments, market sentiment, and macroeconomic trends can all impact the price of Bitcoin.

Risk management is also crucial when trading Bitcoin. By setting stop-loss orders and managing their risk exposure, traders can protect their capital and minimize potential losses. Additionally, staying informed about the latest news and developments in the cryptocurrency market can help traders make timely decisions.

In conclusion, by utilizing a combination of technical and fundamental analysis, practicing effective risk management, and staying informed about market trends, traders can increase their chances of predicting Bitcoin price trends and making profitable trades. This article is important for individuals looking to enhance their trading strategies and maximize their profits in the cryptocurrency market.