- Best platform to buy cryptocurrency

- Crypto live charts

- Crypto fees

- Where to buy bitcoin

- Binance dogecoin usd

- Lossless crypto

- Current eth gas price

- Btc prices

- Bitcash price

- What is crypto coin

- Buy bitcoin online

- Cours crypto

- Mina crypto price

- How much is pi crypto worth

- Will btc go back up

- Cryptocom sell to fiat wallet

- Google bitcoin

- How to buy xrp on cryptocom

- Ripple xrp cryptocurrency

- How does bit coin work

- Mbtc to usd converter

- Crypto credit

- How to fund crypto com account

- How to withdraw money from cryptocom

- To invest all profits in crypto

- Eth btc

- Btc address lookup

- Will ethereum ever reach $10 000 in price

- 3 reasons to buy dogecoin

- Dot crypto

- Cryptocurrency bitcoin price

- Bitcoin starting price

- Largest bitcoin holders

- Cryptocurrency app

- How to buy dogecoin stock on coinbase

- Cheapest crypto on crypto com

- Coindesk bitcoin price

- Eth to usd converter

- How to buy crypto on binance

- Multichain ethereum binance smart chain avalanche

- Crypto earn

- Cryptocurrency exchanges

- Cryptocoin com coin

- Ether converter

- Best websites to buy bitcoin with credit card

- Cryptocurrency prices

- How to add bank account to cryptocom

- Crypto exchange

- How much is bitcoin

- How does btc mining work

- Ethereum gas fees tracker

- Top 20 cryptocurrency

- How much is 1eth

- What's the price of bitcoin

- Amp crypto stock

- How to invest in ethereum

- When to buy bitcoin

- Apps cryptocurrency

- Crypto to usd

- Ethusd converter

- Asm crypto price

- Where to buy bnb crypto

- Will crypto bounce back

- Cryptocom cards

- Bitcoin price going up

- Create cryptocurrency

- How is crypto taxed

- Who own bitcoin

- Dogecoin 20 where to buy

- Eth usdt

- Cryptos

- The crypto

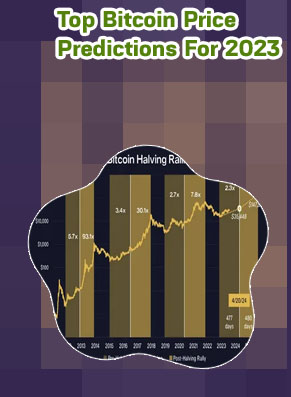

Bitcoin price target

Best wallet for crypto

As June approaches, many investors and enthusiasts are eagerly anticipating the next move in the volatile world of Bitcoin. Predictions for the cryptocurrency's performance in June vary widely, with some experts forecasting a bullish trend while others are more cautious. To help navigate the uncertainty, we have compiled a list of 3 articles that offer insights and analysis on Bitcoin's potential trajectory in the coming month.

Expert Analysis: What to Expect from Bitcoin in June

As an avid investor in the cryptocurrency market, I was eager to read the latest insights on what to expect from Bitcoin in June. The article provided a detailed analysis of the current trends and potential scenarios for the upcoming month. According to the experts, Bitcoin is likely to experience increased volatility due to various factors such as regulatory developments, market sentiment, and macroeconomic conditions.

One key point mentioned in the article is the potential impact of regulatory news on Bitcoin prices. With governments around the world taking a closer look at cryptocurrencies, any new regulations or policies could significantly affect the market. This is something that all investors should keep an eye on in the coming weeks.

Additionally, the experts emphasized the importance of monitoring market sentiment and investor behavior. As we have seen in the past, sudden shifts in sentiment can lead to sharp price movements in the cryptocurrency market. By staying informed and being prepared for all scenarios, investors can make better decisions and manage their risk effectively.

Overall, this article serves as a valuable resource for anyone interested in Bitcoin and the cryptocurrency market. By providing expert analysis and insights, it helps investors navigate the complex and dynamic world of digital assets.

Historical Trends: How Bitcoin Has Performed in June in the Past

As we delve into the historical trends of Bitcoin performance in the month of June, it becomes evident that this particular period has seen a mix of ups and downs for the popular cryptocurrency. Over the years, June has witnessed both bullish and bearish trends, making it a crucial period for Bitcoin investors to closely monitor.

In some years, Bitcoin has experienced significant price surges during June, leading to substantial profits for investors who timed their trades correctly. However, there have also been instances where Bitcoin prices dipped in June, causing losses for those who failed to anticipate the market movements.

One practical use case for analyzing historical trends in Bitcoin performance in June is for traders and investors to develop informed strategies based on past patterns. By studying how Bitcoin has behaved in previous Junes, market participants can make more educated decisions on when to buy, sell, or hold their positions. This approach can help mitigate risks and potentially enhance returns in the volatile cryptocurrency market.

Overall, understanding the historical performance of Bitcoin in June can provide valuable insights for market participants looking to navigate the ever-changing landscape of digital assets. By leveraging past data and trends, investors can better position themselves to capitalize on opportunities and manage risks effectively in the dynamic world of cryptocurrencies.

Market Sentiment: Investor Outlook on Bitcoin for June

As we enter the month of June, market sentiment towards Bitcoin remains cautiously optimistic. After a volatile month of May, investors are closely monitoring key factors that could impact the price of the leading cryptocurrency in the coming weeks.

One major event that could shape Bitcoin's performance in June is the upcoming Bitcoin conference in Miami. The event, which will be attended by industry experts, investors, and developers, is expected to generate significant media attention and could serve as a catalyst for increased interest in Bitcoin.

In addition to the Miami conference, regulatory developments will also play a crucial role in shaping investor outlook on Bitcoin. Recent statements from government officials in various countries, including the United States and China, have sparked concerns about potential crackdowns on cryptocurrencies. Any further regulatory actions could lead to increased volatility in the market.

On the other hand, positive news such as institutional adoption and increased use cases for Bitcoin could help bolster investor confidence in the digital asset. Major companies like Tesla and MicroStrategy have already made significant investments in Bitcoin, signaling growing acceptance of the cryptocurrency in traditional finance.

Overall, the outlook for Bitcoin in June is uncertain, with a mix of positive and negative factors at play. Investors will need to closely monitor market developments and news events to navigate the evolving landscape of the cryptocurrency market.