- Best platform to buy cryptocurrency

- Crypto live charts

- Crypto fees

- Where to buy bitcoin

- Binance dogecoin usd

- Lossless crypto

- Current eth gas price

- Btc prices

- Bitcash price

- What is crypto coin

- Buy bitcoin online

- Cours crypto

- Mina crypto price

- How much is pi crypto worth

- Will btc go back up

- Cryptocom sell to fiat wallet

- Google bitcoin

- How to buy xrp on cryptocom

- Ripple xrp cryptocurrency

- How does bit coin work

- Mbtc to usd converter

- Crypto credit

- How to fund crypto com account

- How to withdraw money from cryptocom

- To invest all profits in crypto

- Eth btc

- Btc address lookup

- Will ethereum ever reach $10 000 in price

- 3 reasons to buy dogecoin

- Dot crypto

- Cryptocurrency bitcoin price

- Bitcoin starting price

- Largest bitcoin holders

- Cryptocurrency app

- How to buy dogecoin stock on coinbase

- Cheapest crypto on crypto com

- Coindesk bitcoin price

- Eth to usd converter

- How to buy crypto on binance

- Multichain ethereum binance smart chain avalanche

- Crypto earn

- Cryptocurrency exchanges

- Cryptocoin com coin

- Ether converter

- Best websites to buy bitcoin with credit card

- Cryptocurrency prices

- How to add bank account to cryptocom

- Crypto exchange

- How much is bitcoin

- How does btc mining work

- Ethereum gas fees tracker

- Top 20 cryptocurrency

- How much is 1eth

- What's the price of bitcoin

- Amp crypto stock

- How to invest in ethereum

- When to buy bitcoin

- Apps cryptocurrency

- Crypto to usd

- Ethusd converter

- Asm crypto price

- Where to buy bnb crypto

- Will crypto bounce back

- Cryptocom cards

- Bitcoin price going up

- Create cryptocurrency

- How is crypto taxed

- Who own bitcoin

- Dogecoin 20 where to buy

- Eth usdt

- Cryptos

- The crypto

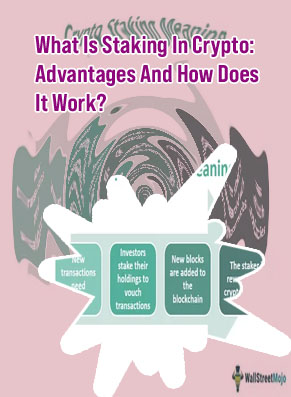

What does staking crypto mean

Best wallet for crypto

Staking crypto has become a popular way for cryptocurrency holders to earn passive income by participating in the validation process of transactions on a blockchain network. This process involves users locking up their coins as collateral to support the network's security and operations. To better understand what staking crypto means and how it works, check out the following articles:

Demystifying Crypto Staking: A Beginner's Guide

Cryptocurrency staking has become an increasingly popular method for investors to earn passive income in the digital asset space. For beginners looking to understand and navigate this complex world, a comprehensive guide is essential.

This beginner's guide breaks down the concept of crypto staking into easily digestible terms, making it accessible for newcomers to the market. It starts by explaining what staking is and how it differs from other forms of investing in the crypto sphere. The guide then delves into the various types of staking, such as proof of stake and delegated proof of stake, providing a detailed overview of each.

One of the key takeaways from this guide is the importance of choosing the right cryptocurrency to stake. Factors such as potential returns, security, and network participation are all crucial considerations for investors. Additionally, the guide outlines the steps involved in setting up a staking wallet and participating in a staking pool.

Overall, "Demystifying Crypto Staking: A Beginner's Guide" serves as an invaluable resource for individuals looking to enter the world of crypto staking. By providing clear and concise information, this guide is essential for anyone interested in earning passive income through staking cryptocurrencies.

The Benefits of Staking Crypto and How to Get Started

Staking has become a popular way for cryptocurrency holders to earn passive income while supporting the network. By staking their coins, investors can help validate transactions and secure the blockchain, all while earning rewards in the form of additional coins. This process not only benefits the individual staker, but also helps to strengthen the overall network by increasing security and decentralization.

One of the key benefits of staking crypto is the potential for high returns. Many staking coins offer annual returns of 5-20%, far surpassing traditional savings accounts or other investment options. Additionally, staking requires minimal effort on the part of the investor, making it an attractive option for those looking to earn passive income.

To get started with staking, investors will need to choose a suitable staking coin and set up a wallet that supports staking. They will then need to transfer their coins to the wallet and begin the staking process. While staking does come with some risks, such as potential loss of funds if the network is compromised, many investors find the potential rewards to outweigh these risks.

Overall, staking crypto can be a lucrative investment option for those willing to do their research and take the necessary precautions. By understanding the potential benefits and risks of staking, investors can make informed decisions about